fha gift funds cousin

FHA loans do not require notarization of. The FHA also allows gifts from an employer labor union or a charitable organization.

Mortgage Down Payment Gift Rules What You Should Know

Consequently does FHA consider a cousin a family member.

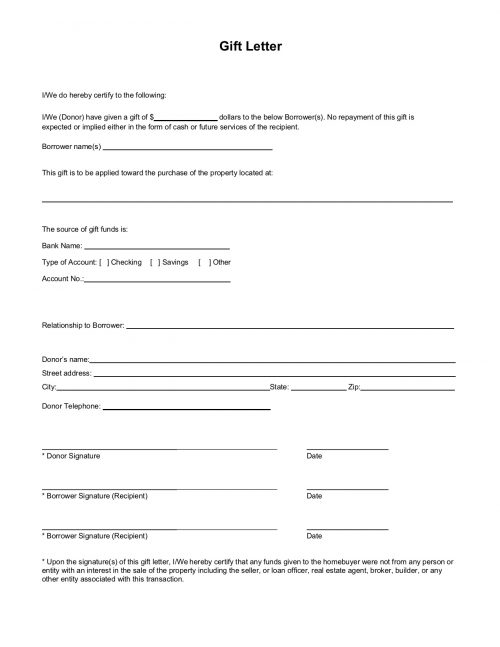

. A certification from the donor stating that he or she has lived with the borrower for the past 12 months and will continue to do so in the new residence. When a gift from a relative or domestic partner is being pooled with the borrowers funds to make up the required minimum cash down payment the following items must also be included. USDA VA Loans.

Provide executed gift letter. HUD 40001 has the guidelines. First gift funds can only be used for down payments and closing costs.

All funds needed to complete the transaction can come from a gift. The gifted funds must be sourced and seasoned and cannot be borrowed by the donor. 1 After the minimum borrower contribution has been met gifts can be used to supplement the down payment closing costs and reserves.

This requirement is also spelled out in the aforementioned HUD handbook. FHA Gift Funds Guidelines state that 100 of gift funds may be used for the down payment andor closing costs but both HUD and AUS do not view gift funds favorably. The only difference is that normal FHA guidelines say you cant use gift funds from cousins nieces or nephews.

The very long standing standard mortgage loan rules require gift money to be from a blood relative or a substantial person with a documented interest in the buyer. There are strict rules and regulations with FHA Guidelines On Gift Funds Mortgage Requirements. According to HUD 41551 Chapter Five Section B In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower.

Also Parent or grandparent includes a step-parentgrandparent or foster parentgrandparent. If you have applied for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that section. While cousins nieces and nephews arent able to giveyour giftunder normal family guidelines with an FHA loan the FHA doesallow for giftsfrom close friends who have a clear interest in your life.

Seller Concessions and Reserves. The new FHA Policy changes. Cousins nieces and nephews dont count under normal family guidelines but they do allow gifts from close friends that can include extended family including cousins nieces and nephews.

Gift Funds Yet To Be Received. FHA loan rules are very precise when it comes to the source of money used for a down payment. FHA Gift Funds Guidelines allow 100 gift funds from family members andor relatives to be used as a down payment towards a home purchase.

Home Buyers cannot use gift funds for reserves that are required by lenders. FHA now defines a RelativeFamily Member as. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower.

Like a conventional loan FHA loans allow almost all of your family members including future in-laws to provide you with a gift for your down payment. The portion of the gift not used to meet closing requirements may be counted as reserves. The answer to this question depends on whether the Borrower is applying for a Conventional Mortgage or a FHA Mortgage.

Two- to four-unit principal residence. The borrower must make a 5 minimum borrower contribution from his or her own funds. Does FHA allow a gift from a cousin.

FHA Guidelines On Gift Funds state that home buyers can get 100 gift funds to purchase their home. However the FHA does allow for gifts from close friends and under those circumstances nieces nephews and cousins would qualify. Gift funds may fund all or part of the down payment closing costs or financial reserves subject to the minimum borrower contribution requirements below.

FHA loan rules dont just regulate the source of funds in this way it also governs who may provide such gifts. Also Know who does FHA consider a family member. Gifts refer to the contributions of cash or equity with no expectation of repayment Yes the above quote from the FHA loan rule book states that equity can be provided instead of hard cash.

A child parent or grandparent. You dont mention who is the gifting person but it cant just be anyone. FHA also allows gifts from employers labor unions and charitable organizations.

However FHA has changed their definition of a RelativeFamily Member to NO LONGER include COUSINS. Herein can a cousin give a gift on an FHA loan. With FHA loans all of the above are acceptable as gift donors except nieces nephews and cousins.

FHA Single Family Housing Policy Handbook Glossary Handbook 40001 Glossary and Acronyms 1 Last Revised 12302016 FHA Single Family Housing Policy Handbook GLOSSARY 30-Day Account A 30-Day Account refers to a credit arrangement that requires the Borrower to pay off the outstanding balance on the account every month. Gift Funds-Down payment funds can be gifted from a relative spouse or a domestic partner. 41551 5B4b Who May Provide a Gift An outright gift of the cash investment is acceptable if the donor.

Sellers Concessions-FHA mortgage requirements allow for seller concessions of up to 6 of the sales price. A borrower cannot use proceeds from a non-collateralized loan such as a payday loan or credit card cash advance to make a down payment and if gift funds are used the money must come to the borrower with no obligations. From HUD 40001 gifts may be provided by.

In order to establish whether a particular gift of down payment money is permitted we have to examine what the FHA describes as a bona fide gift. Therefore when Gift Funds are going to be part of the funds to purchase a home it is important to establish early on Who Is An Acceptable Donor To Provide Gift Funds For A Mortgage. It states that the lender must document the transfer of gift funds from the donor to the borrower.

A common example of this is a fiancee or boyfriend or girlfriend. In addition to the gift letter mentioned above mortgage lenders usually request bank statements from the family member or donor who is providing the FHA down payment gift. Fannie Mae Gift Funds Guidelines A borrower of a mortgage loan secured by a principal residence or second home may use funds received as a personal gift from an acceptable donor.

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Down Payment And Gift Rules Still Apply

Fha Gift Funds How Can I Use Them To Buy A Home

18 Stick In There Quotes For The Parent Who Wants To Give Up Parenting Quotes Inspirational My Children Quotes Quotes For Kids

Fha Loan Rules For Down Payment Gift Funds

Jaz Cards Happy Birthday Money Card Creative Money Gifts Money Cards Money Gift